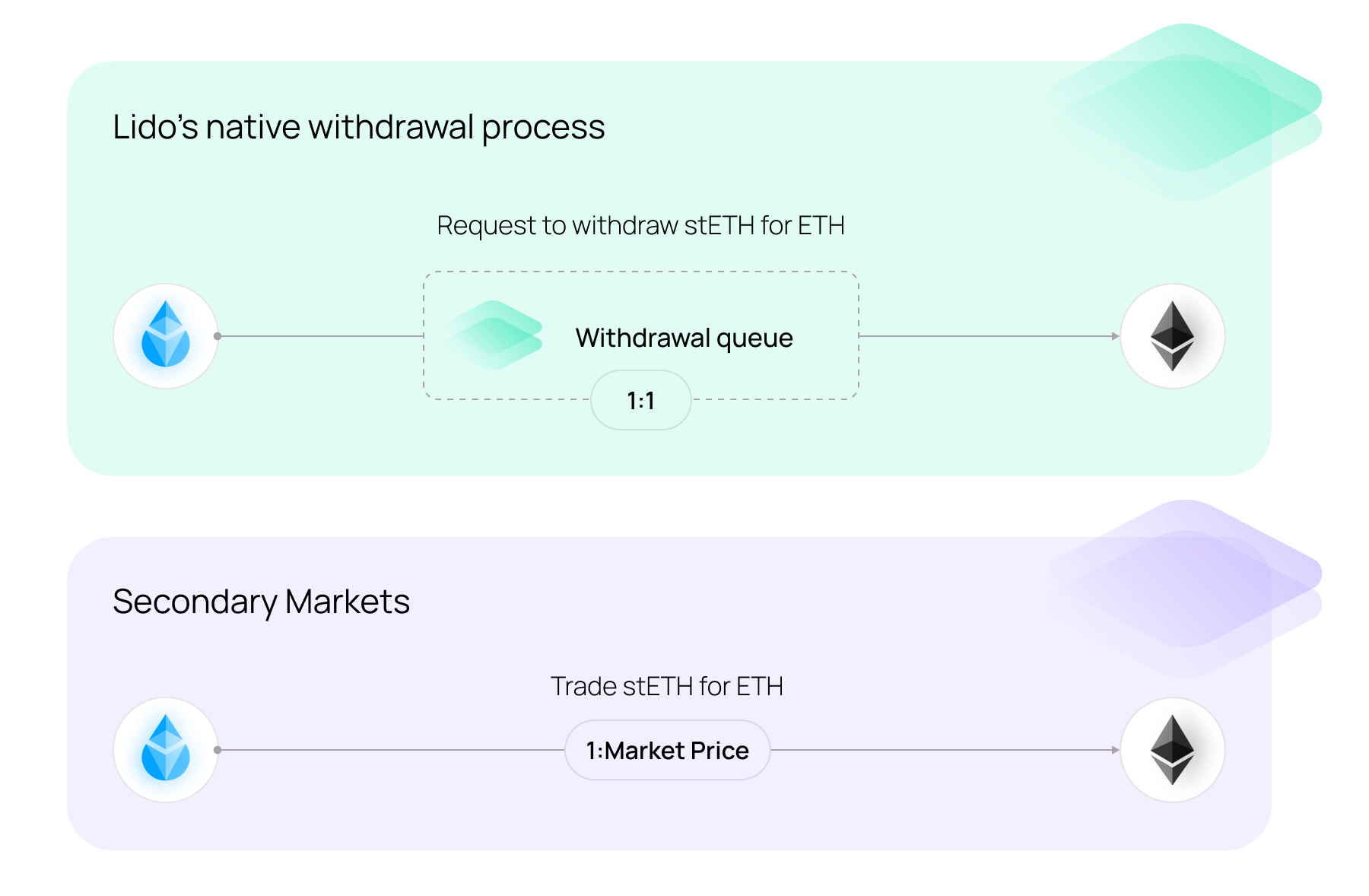

Withdrawing staked ETH from Lido can be done through the protocol's Withdrawal Queue or by swapping stETH on secondary markets, providing flexibility for users based on their needs and market conditions.

Withdrawing staked ETH from Lido can be done through the protocol's Withdrawal Queue or by swapping stETH on secondary markets, providing flexibility for users based on their needs and market conditions.

Protocol Withdrawal Queue

To redeem stETH for ETH, users can utilize the Lido protocol's native withdrawal process. By placing stETH in the Withdrawal Queue, users join a First-In-First-Out (FIFO) line. The maximum withdrawable ETH amount matches the stETH provided for redemption and cannot exceed this amount. While in the queue, users remain exposed to slashing risks — this prevents attempts to avoid losses that are socialized across the protocol. Withdrawal time depends on the queue size, Ethereum's validator exit rate, and the available ETH in the Lido Buffer. Estimated wait times are displayed before submitting or checking requests on the stake.lido.fi interface. Details of the estimation algorithm are available here.

Secondary Markets

As a liquid token, stETH can be traded on decentralized (DEXs) or centralized exchanges (CEXs) without waiting for the unstaking process. Selling stETH for ETH or other tokens provides instant liquidity, but the price may differ from ETH based on market supply and demand. Unlike stablecoins, stETH is intentionally not pegged to ETH.

Withdrawal Queue Process

Lock stETH in the WithdrawalQueue contract to initiate withdrawal and receive an unstETH (see below) representing the queued position and projected ETH amount.

The Lido Buffer prioritizes fulfilling withdrawals using available ETH. If insufficient, validators are exited to meet the demand.

Withdrawals follow a FIFO order, finalized in daily batches when the AccountingOracle updates protocol balances and burns the corresponding stETH.

Once finalized, users burn their unstETH NFT to receive ETH, completing the process.

Withdrawal times depend on queue size, buffer availability, and validator exit dynamics. High demand may increase wait times, with secondary markets providing an alternative for quick liquidity

unstETH

unstETH is a non-fungible token (NFT) that represents withdrawal requests you've placed in the protocol. When you initiate a withdrawal, unstETH is minted to represent your position in the withdrawal queue. This token is transferable and can potentially be integrated into DeFi applications. Each unstETH token includes:

- A unique incremental ID representing your position within the withdrawal queue.

- The amount of stETH you've requested to withdraw.

- Once finalized and not yet claimed, the amount of ETH to be transferred to you.

When you claim your ETH, the unstETH token is burned, completing the withdrawal process.