Competitive Rewards with Less ETH

The Community Staking Module (CSM) is a Lido staking module with permissionless entry, allowing any operator to run validators with less ETH and improved capital efficiency compared to solo staking.

up to 5.59%*

CSM staking APR

1.5 - 2.4 ETH

Initial capital requirement

539

Permissionless operators registered

5.91%

Permissionless staking share

All APR values and rewards referenced on this page are estimates based on current conditions and may vary. Nothing here guarantees future rewards. Penalties may apply. Do your own research before engaging.

CSM or Solo Staking? Why not both!

Run CSM validators on your existing solo staking setup with ease

CSM

Solo staking

APR

up to 5.59%*

2.36%*

Capital requirements

1.3 - 2.4 ETH

32 ETH minimum

Middleware-free

Yes

Yes

Low/no-code setup tools

Yes

Yes

Smoothing rewards

Yes

No

Performance tolerance

Yes

No

CSM Reward Structure

Enter ETH amount you can provide as a bond

Required bond

2.4 ETH

Excess bond

0 ETH

Annual rewards

0.07 ETH

Bond rebase

2.12% (0.05 ETH)

Node Operator rewards

1.1% (0.02 ETH)

Capital multiplier

1.36x

Reward rates

3.23%* APR

Default

VS

2.36%* APR

Solo staking

Default

ICS

Solo staking

This chart shows how reward allocation may differ between staking setups, and does not represent guaranteed results. Actual outcomes and rewards vary based on factors such as network conditions and validator performance.

Simple Staking with CSM

Take advantage of the variety of solutions integrated with CSM to improve your validator node operations

Low/no-code Integrations

Run with DVTs

Validator as a Service (VaaS)

Performance Tracking

Low/no-code Integrations

Use Plug & Play solutions for a smoother validator node setup experience

Validator as a Service (VaaS)

Participate in the network via VaaS without needing to bootstrap or maintain a validator node

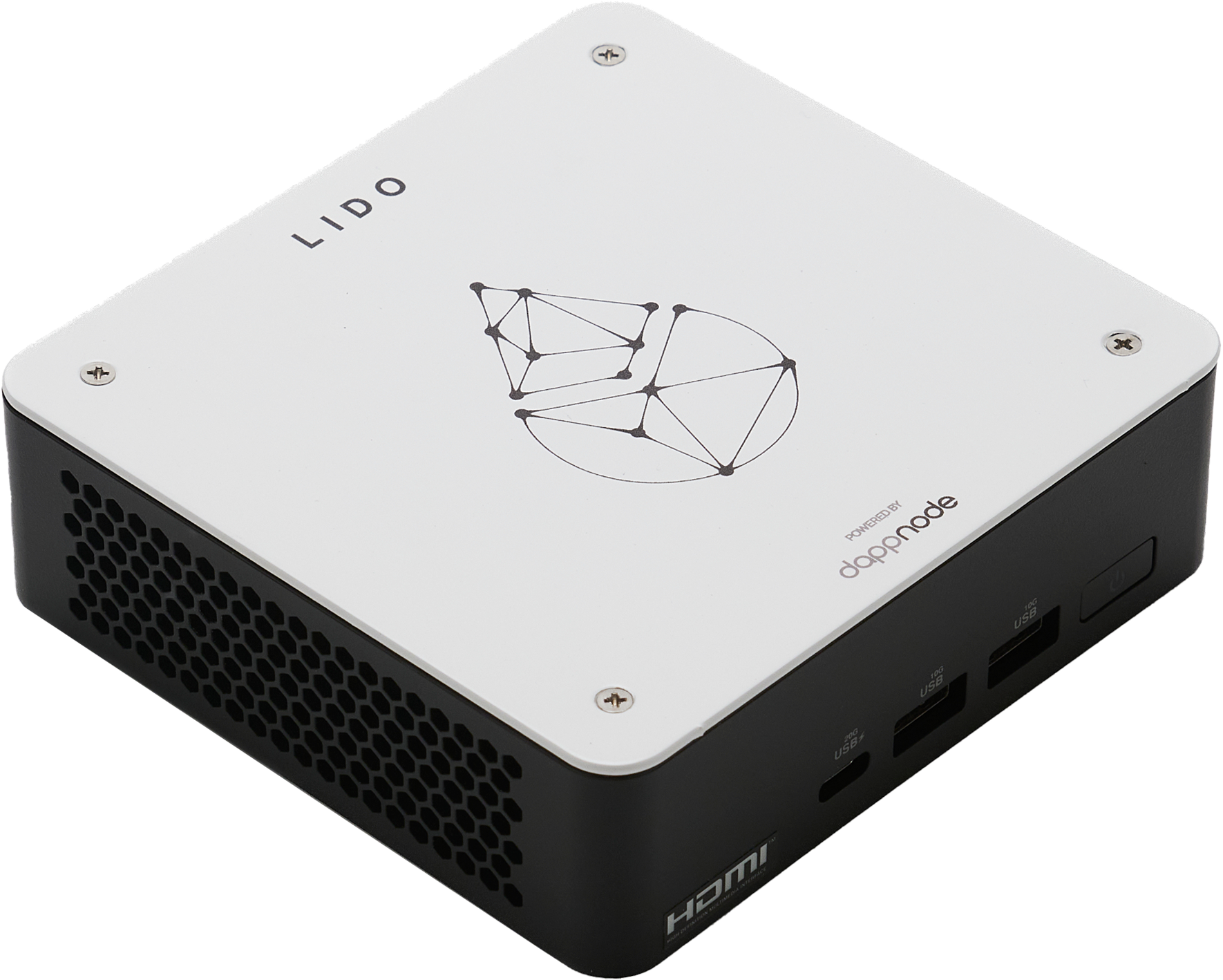

Pre-built Hardware for an Easier Start

A plug-and-play Dappnode machine is available for those who prefer starting with pre-assembled validator hardware. It comes with Dappnode Core installed and meets all requirements for running Ethereum validators at home, including with CSM.

Buy Dappnode

Embrace the Community Energy

ETHCC 2025 - Lido Stakers Guild [Cannes]

From local meetups to global events, community members are gathering in cities around the world to connect, collaborate, and inspire one another through shared experiences and stories.

Get event updatesFAQ

The Ethereum network is secured through the Proof-of-Stake based consensus mechanism. It involves locking a minimum of 32 ETH per validator in the deposit contract to enable validator participation in the Ethereum consensus. Validators attest to and propose blocks, and as a consequence, they may receive rewards from consensus incentives and Execution Layer priority fees/MEV. Downtime can incur penalties, and serious faults or malicious behavior can result in slashing - the forced exit of a validator and a corresponding loss of staked ETH.

* APR/APY figures are estimates, not guaranteed, and are subject to change based on network conditions.

Rewards may fluctuate and are influenced by factors outside the platform’s control, including changes to blockchain protocols and validator performance. Past performance does not guarantee future results. Rewards are not assured and depend on the specific rules and mechanisms established by each underlying blockchain network. Users should conduct their own research, seek professional advice, and ensure they understand the risks before participating.

Your privacy matters. We use cookieless analytics and collect only anonymized data for improvements. Cookies are used for functionality only. For more info read Privacy Notice.