The Lido protocol has two different staking flows: Lido Core, the established and widely recognized staking flow, and stVaults, a cutting-edge staking primitive that will be introduced in the upcoming Lido V3.

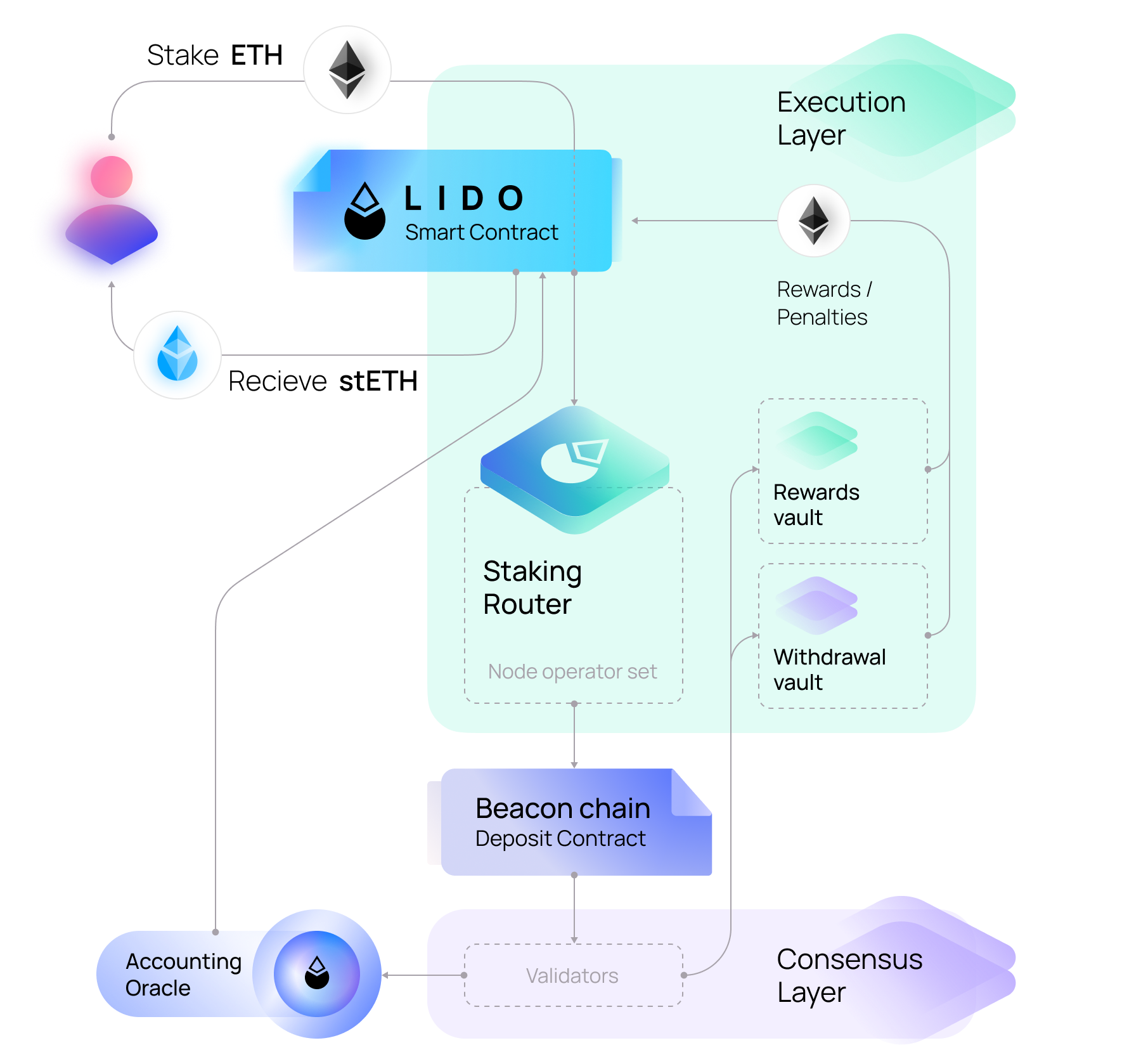

Submitting ETH to the Lido Core Protocol initiates a seamless staking process. Deposited ETH is gathered in the Lido Buffer, and in return, you immediately receive stETH tokens.

Buffered ETH is used either to activate new validators on the Consensus Layer, depending on staking demand, or to fulfill stETH-to-ETH withdrawal requests, ensuring efficient liquidity management.

Lido Buffer

When you stake via the Lido protocol, your ETH is first placed in the Lido Buffer, the ETH balance of the Lido stETH token contract. The buffer gathers deposits until there’s enough ETH to activate new validators in 32 ETH increments, and then deposits this ETH to the Beacon Chain, taking into account gas costs and staking efficiency. This process is overseen and effected by the Deposit Security Module.

The buffer also enhances liquidity for stETH redemptions. If users want to exit their stETH positions, the buffer prioritizes fulfilling these requests, minimizing the need to exit validators and avoiding delays associated with validator withdrawal periods.

Minting stETH

When you deposit ETH into Lido Core, you receive stETH tokens at a 1:1 ratio. These tokens represent your share of the staked ETH, including rewards earned and penalties incurred. As an ERC-20 token, stETH is fully transferable and can be used across DeFi, maintaining liquidity while your tokens remain staked.

Rewards and penalties are socialized amongst all stETH holders, which means that all stETH is fungible. From the moment stETH is minted, you start accruing rewards and are exposed to potential penalties. You can track your rewards by entering your wallet address here.

If you are using wrapped stETH (wstETH), note that your balance does not change with each rebase. Instead, the value of wstETH increases over time to reflect accrued rewards.

Routing Deposits to Validators

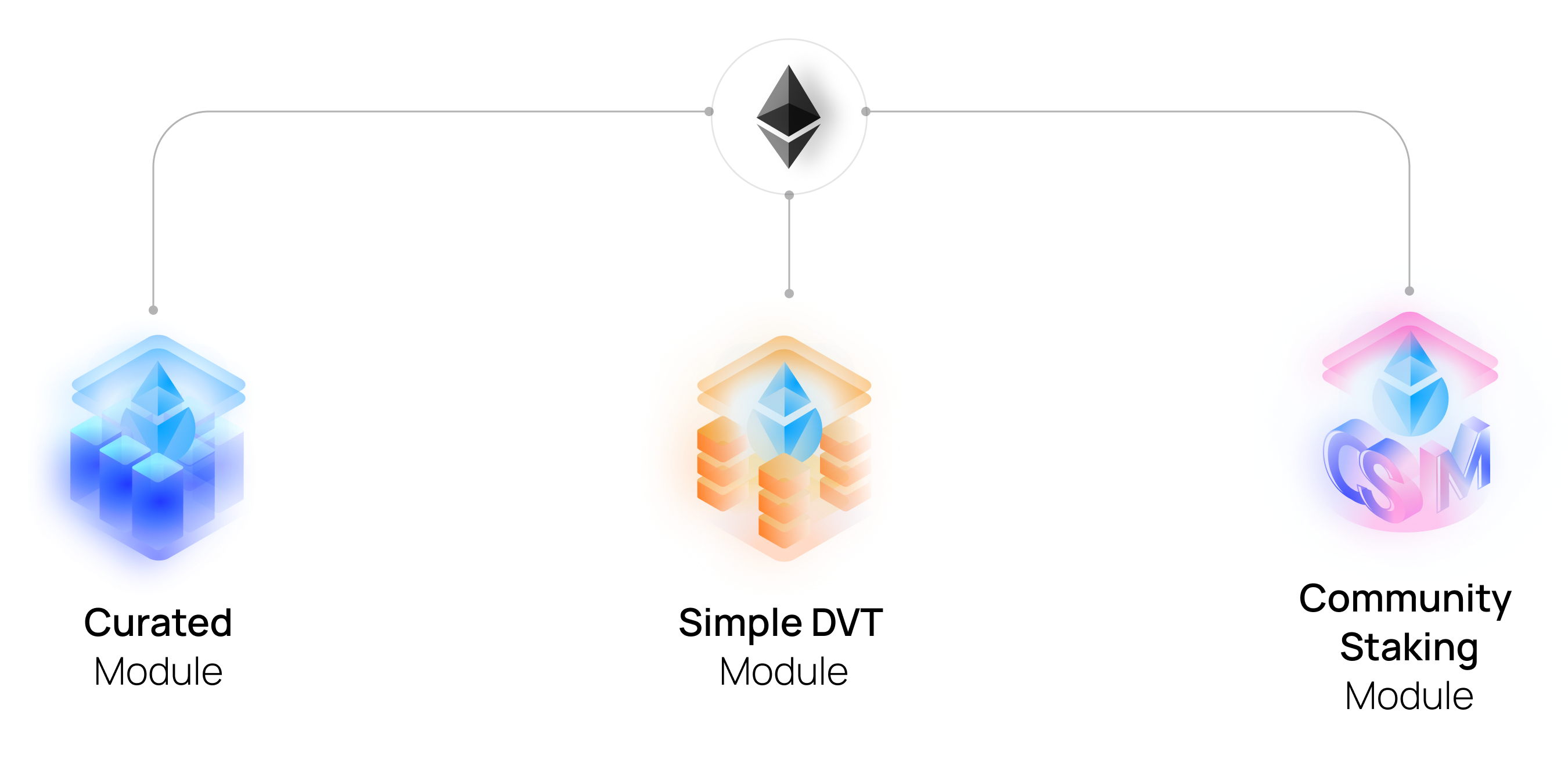

Users do not select specific modules or node operators for staking. Once the Lido Buffer accumulates enough ETH, the Staking Router automatically allocates it to validators. The router distributes ETH across the connected staking modules — Curated Registry Module, Community Staking Module (CSM), and Simple Distributed Validator Technology (SimpleDVT) — following the programmatic allocation rules defined within the Lido smart contracts.

Users do not select specific modules or node operators for staking. Once the Lido Buffer accumulates enough ETH, the Staking Router automatically allocates it to validators. The router distributes ETH across the connected staking modules — Curated Registry Module, Community Staking Module (CSM), and Simple Distributed Validator Technology (SimpleDVT) — following the programmatic allocation rules defined within the Lido smart contracts.

Each module has its own rules with respect to how stake is allocated to depositable validators. Deposited ETH is then locked in Ethereum’s staking deposit contract on the Execution Layer and credited to the corresponding validators on the Consensus Layer, enabling them to secure the network. For more information, check out the detailed explanations in the Node Operator Portal for each module: Curated Module, Simple DVT Module, Community Staking Module.