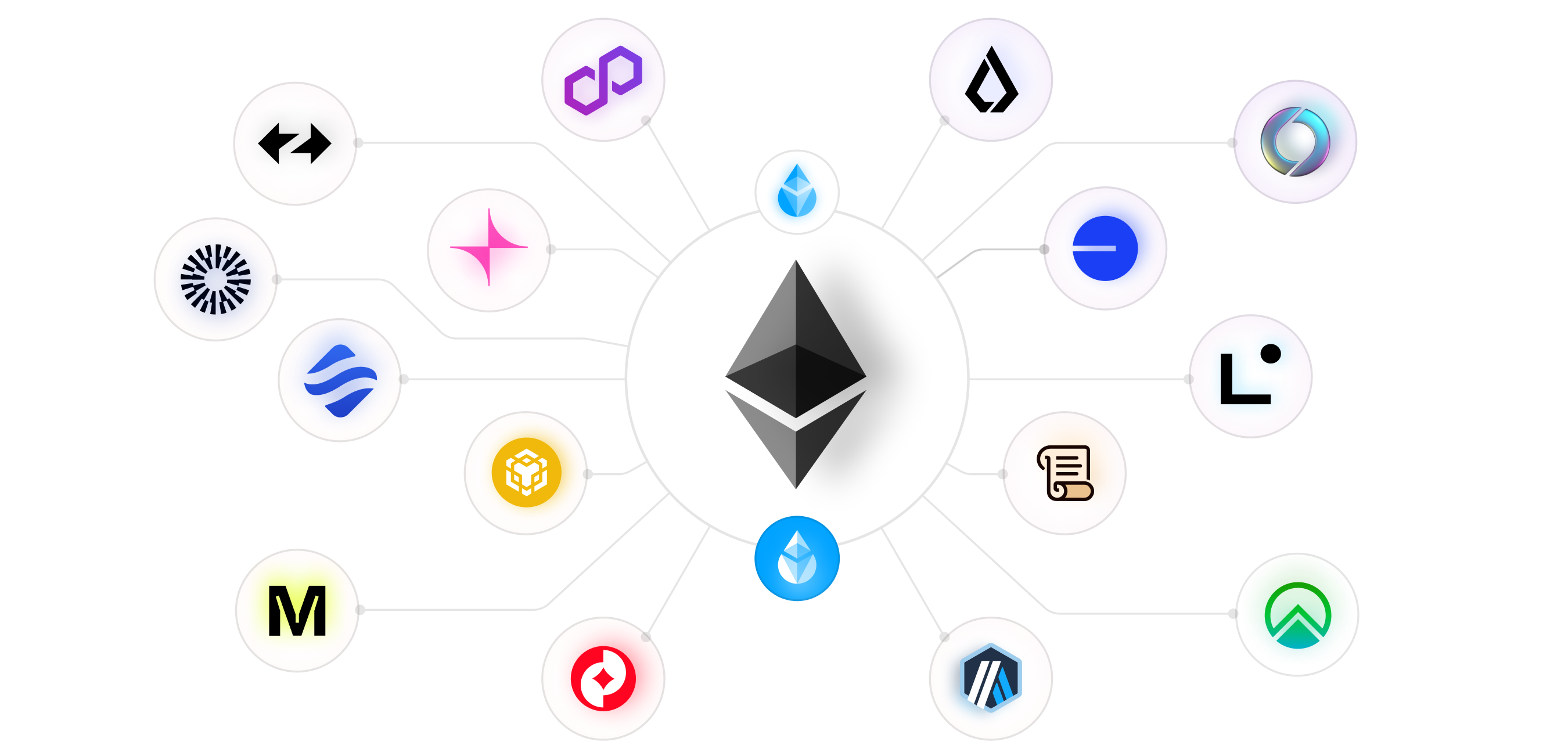

Lido protocol's liquid staking tokens, stETH and wstETH, are primarily issued on the Ethereum network. However, for better adoption and utility, the Lido DAO supports bridging these tokens to various other blockchain networks. This multichain approach allows users to leverage stETH and wstETH across different ecosystems, benefiting from lower fees, faster transactions, and different DeFi opportunities.

Lido protocol's liquid staking tokens, stETH and wstETH, are primarily issued on the Ethereum network. However, for better adoption and utility, the Lido DAO supports bridging these tokens to various other blockchain networks. This multichain approach allows users to leverage stETH and wstETH across different ecosystems, benefiting from lower fees, faster transactions, and different DeFi opportunities.

Supported Networks

stETH and wstETH can be bridged to several Layer 2 (L2) and Layer 1 (L1) networks, including OP Mainnet, Base, Arbitrum, Polygon PoS, zkSync, Linea, Mantle, Scroll, BNB Chain, Zircuit, Unichain, Mode, Lisk, Soneium, and Swellchain.

Each network may have specific requirements and supported token formats. Details on which tokens are supported on which chain can be found here.

Token formats: stETH vs. wstETH

- stETH is a rebasing token, meaning its balance increases daily to reflect staking rewards. However, many DeFi protocols and bridges do not support rebasing tokens, which can lead to complications.

- wstETH is a non-rebasing, wrapped version of stETH. Its balance remains constant, and staking rewards are reflected in the token's value. Due to its compatibility, wstETH is generally recommended for bridging and DeFi integrations. Both tokens can be bridged, but not all networks support bridging stETH (only OP Mainnet, Unichain, and Soneium are available).

Bridging considerations

When bridging stETH or wstETH:

- Use recognized bridges: Prefer native bridges provided by the destination network (e.g., Arbitrum's canonical bridge) for enhanced security and compatibility.

- Be aware of risks: Bridging involves smart contracts and, in some cases, third-party validators. Understand the associated risks, including potential smart contract vulnerabilities and liquidity issues on the destination chain.

- Check liquidity: Ensure that the destination network has sufficient liquidity for stETH or wstETH to facilitate smooth transactions and interactions.

- Verify Token Contracts: Always confirm that you're interacting with the correct token contracts on the destination network to avoid scams or unsupported tokens. For a comprehensive overview of bridging risks and best practices, please follow the Bridging stETH/wstETH: A Guide To Risks & Best Practices.

Using stETH and wstETH on Other Networks

Once bridged, stETH and wstETH can be utilized in various DeFi protocols on the destination networks. This includes lending platforms, liquidity pools, and more reward opportunities. The availability of these services varies by network, so it's essential to research and understand the DeFi opportunities of the specific chain you're engaging with.

For more information on DeFi integrations and opportunities, visit the Lido Multichain page.