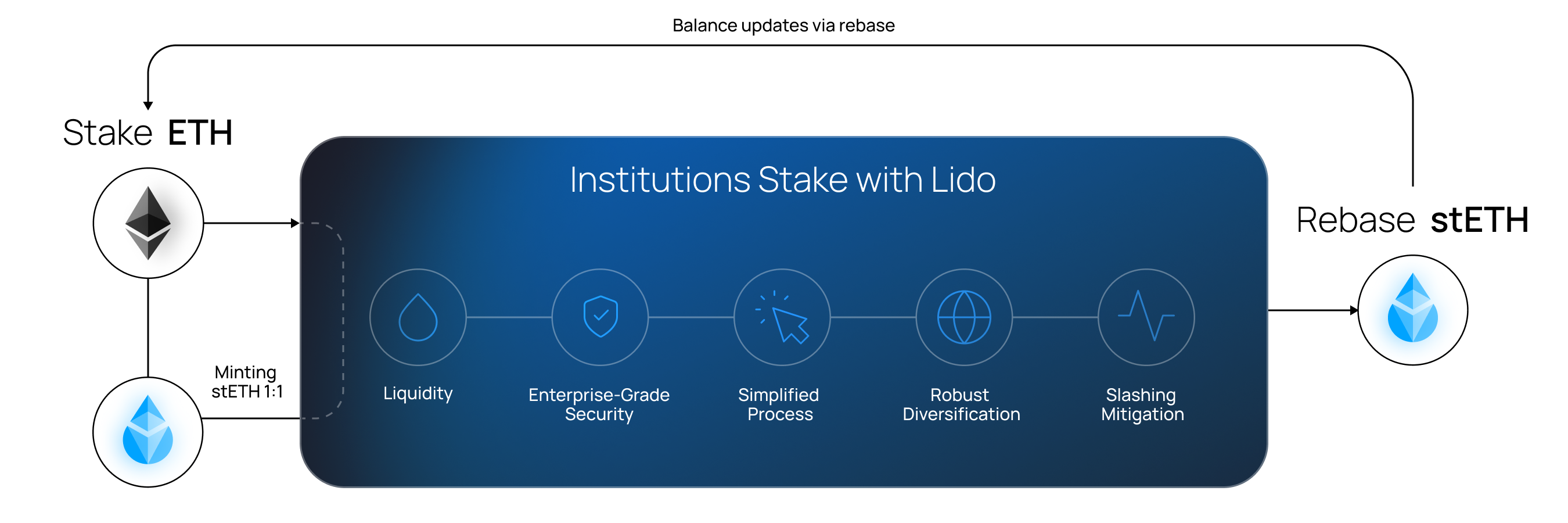

For institutions seeking to participate in liquid staking, the Lido DAO offers a dedicated path: institutional staking via the stETH token. Rather than setting up and running validators in-house, an endeavor that demands significant capital, infrastructure, monitoring, and operations, institutions can delegate ETH to the Lido protocol, receive stETH, and retain full liquidity and on-chain transparency.

For institutions seeking to participate in liquid staking, the Lido DAO offers a dedicated path: institutional staking via the stETH token. Rather than setting up and running validators in-house, an endeavor that demands significant capital, infrastructure, monitoring, and operations, institutions can delegate ETH to the Lido protocol, receive stETH, and retain full liquidity and on-chain transparency.

In practical terms, this means organizations can integrate stETH into their existing custody, treasury, and trading workflows while staking rewards accumulate automatically on-chain. Institutions benefit from a diversified and professionally managed validator set, slack exposure to validator-slashing risks, and access to native integrations with trusted infrastructure providers such as Fireblocks, BitGo, and Copper, and many more.

Lido Institutional's staking pathway has been shaped with awareness of the specific requirements of larger organizations, including the need for compliance processes, custody management, and alignment with internal governance or risk controls. These features ensure that institutions can participate in network security and staking rewards while maintaining the procedural standards expected in their operations.

In this way, Lido Institutional serves as a bridge between decentralized staking and traditional institutional practices, enabling participation in Ethereum’s consensus process while maintaining flexibility, transparency, and operational compatibility with enterprise infrastructure. Learn more.